The Issue

Olentangy Schools will be on the March 19, 2024 ballot with a single issue with three parts – an operating levy, a permanent improvement levy and a bond issue. The money raised from the passage of this issue will allow Olentangy to continue to provide the level of educational excellence and opportunities that our community values. If approved, the March 2024 ballot issue will not be collected until 2025.

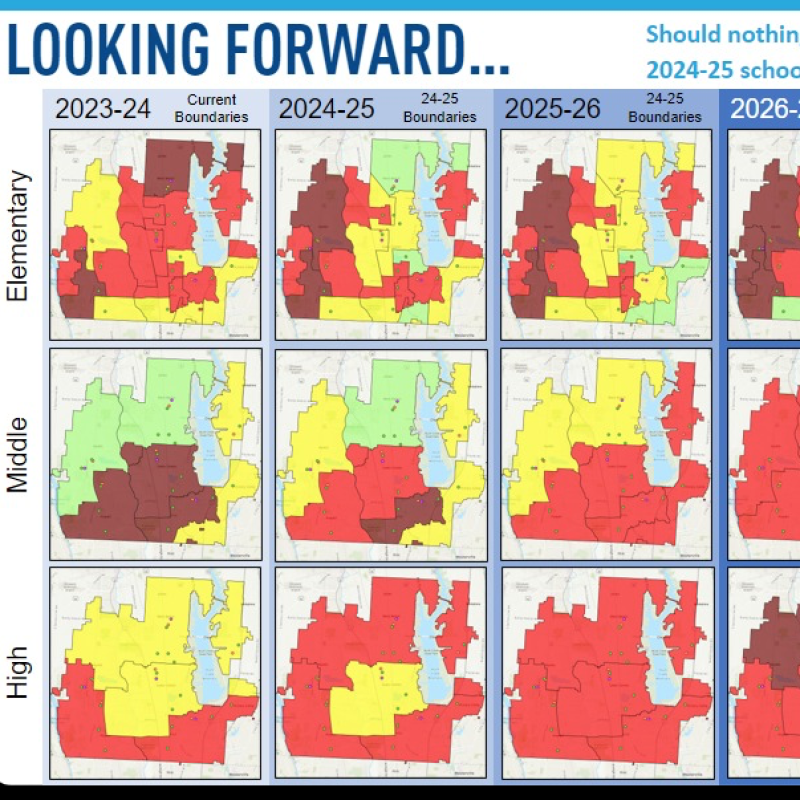

The school district projects enrollment will grow by approximately 5,000 students over the next decade. According to the district, that represents a 20% increase in student enrollment and would far exceed the building capacity at all school levels.

| Description | Mills |

|---|---|

|

Operating Levy |

3.0 |

|

Permanent Improvement Levy |

1.25 |

|

No Additional Mill Bond Package |

0 |

|

Total |

4.25 |

The cost to taxpayers for the 4.25 mills on this ballot issue is $148.75 per $100,000 of home valuation per the County auditor. This amount is in addition to what taxpayers currently pay in school property taxes. Both the operating levy and the permanent improvement levy are permanent, as all prior operating levies have been in Olentangy.

Olentangy Schools is requesting the lowest operating millage increase in more than 30 years, primarily due to long-awaited funding relief as Ohio lawmakers prioritized fair school funding in the biennium budget last summer. This included efforts by members of the community-led OLSD Advocacy Committee. The effort also included OLSD superintendents, treasurers and school board members meeting with and providing testimonies to the Ohio legislature for the purpose of advocating for Olentangy taxpayers.

While the increase is state funding has reduced the operating levy request, it does not eliminate the need for a levy entirely due to the current and projected enrollment growth.

According to the Facilities Committee and the district leadership, if the schools are not built, multiple elementary schools in all areas of the district will likely have trailer classrooms. In addition, projected continuous, multiple redistrictings - at all building levels - to balance overcrowding and multiple district-wide overflow placements are likely throughout the district.

Operating Levy Information

Operating levy dollars pay for day-to-day expenses such as personnel, utilities, and classroom supplies. It allows the district to hire and retain quality teachers and other personnel in order to meet the needs of the district’s continued enrollment growth.This will help keep class sizes at appropriate levels and reduce or eliminate the use of modular classrooms. The district will also use operating levy dollars to expand security personnel to include elementary schools.

Permanent Improvement (PI) Levy Information

This Permanent Improvement portion of the ballot issue will generate approximately $7.9 million annually for maintenance and upkeep on all Olentangy facilities. By placing this on the ballot as a permanent improvement levy, these funds must be used exclusively to maintain buildings, property and other capital needs. The upkeep of the school district's buildings is critical to extending their useful lives.

Bond Package Information

The total bond package is for $350 million.

Based on the projected enrollment growth, the district’s Facilities Committee has recommended building three elementary school, one middle school and one high school. The Facilities Committee is a group of district taxpayers with extensive professional expertise in construction, architecture and technology who meet and collaborate with the Facilities team from the district. Based on the committee's recommendation as well as additional research, the school board then determined that the best option to manage current overcrowding and projected enrollment growth is to adopt the Facilities Committee's recommendations.

Additional facts:

-

Passing this issue in March 2024 ensures that two elementary schools can be built in time to open for the 2025-26 school year, a high school can be built in time to open for the 2027-28 school year, and a middle school and another elementary school can be built to open for the 2028-29 school year.

-

According to Olentangy Treasurer Ryan Jenkins, “The new buildings will allow the District to minimize the use of trailers and the practice of overflowing, which means shuttling students who live in one attendance boundary to attend school in another attendance boundary. We will also be able to redistrict for future growth in a much more efficient and comprehensive manner.”

-

Due to rapid growth in our community, the district plans to have the bond portion of the ballot issue collected at "no additional mills". This allows future residents to pay more of their fair share because the district’s growth allows them to structure the debt in a way that doesn’t raise taxpayers’ current rate for school bonds.

-

This plan addresses growth while keeping our tax rates lower than under a traditional bond funding model, which would require current residents to pay more than future residents.

-

Money raised through the issuance of bonds can only be used for the building of new buildings, remodeling of existing buildings, purchase of land for future buildings or purchase of new equipment (like buses and building mechanicals). Bond money cannot be used for operating expenses, which include staff salaries, utilities and everyday expenses.

$350 million No Additional Millage Bond Details:

Project Cost Open Date Elementary School #18

$32,050,529

August 2025

Elementary School #19

$32,050,529

August 2025

Elementary School #20

$36,462,497

August 2028

Middle School #7

$76,727,897

August 2028

High School #5

$140,406,416

August 2027

Offsite Utility Cost for Construction

$3,000,000

Construction Contingency

$4,184,376

Shanahan Improvements

$1,500,000

as soon as possible

Security Upgrades

$1,000,000

as soon as possible

High School Theater Updates including lighting, sound, painting

$3,000,000

as soon as possible

Musical instrument replacements

$1,000,000

as soon as possible

Buses for growth

$3,861,451

Stadium updates (e.g., fencing, scoreboards, tracks, lighting)

$3,000,000

as soon as possible

Support facilities for transportation, technology, and maintenance

$7,256,306

as needed

Land for future growth

$4,500,000

as needed