FAQs

There are financial benefits to taxpayers to pass the levy this year rather than waiting another year or two. The Facilities Committee anticipates inflationary increases in building costs and unnecessary spending for more trailers if the levy passage is delayed. In addition, Olentangy Treasurer Ryan Jenkins told attendees at a recent Community Conversation that his projections show that waiting a year to pass this ballot issue would result in the operating levy portion to increase from 3.0 mills to 4.5. Combined with the permanent improvement levy, the total ask would be 5.75 mills, which equates to an ADDITIONAL $210 in taxes annually on a $400,000 home valuation.

The district has shared this additional information:

"12 of Olentangy's 16 elementary school buildings are currently at 100% capacity or higher, with the remaining four elementary schools at 90% capacity or higher. The ideal utilization of our school buildings is 80%-85% to allow for specialized instruction, collaboration space and more.

“The new buildings will allow the District to minimize the use of trailers and the practice of overflowing, which means shuttling students who live in one attendance boundary to attend school in another attendance boundary. We will also be able to redistrict for future growth in a much more efficient and comprehensive manner.”

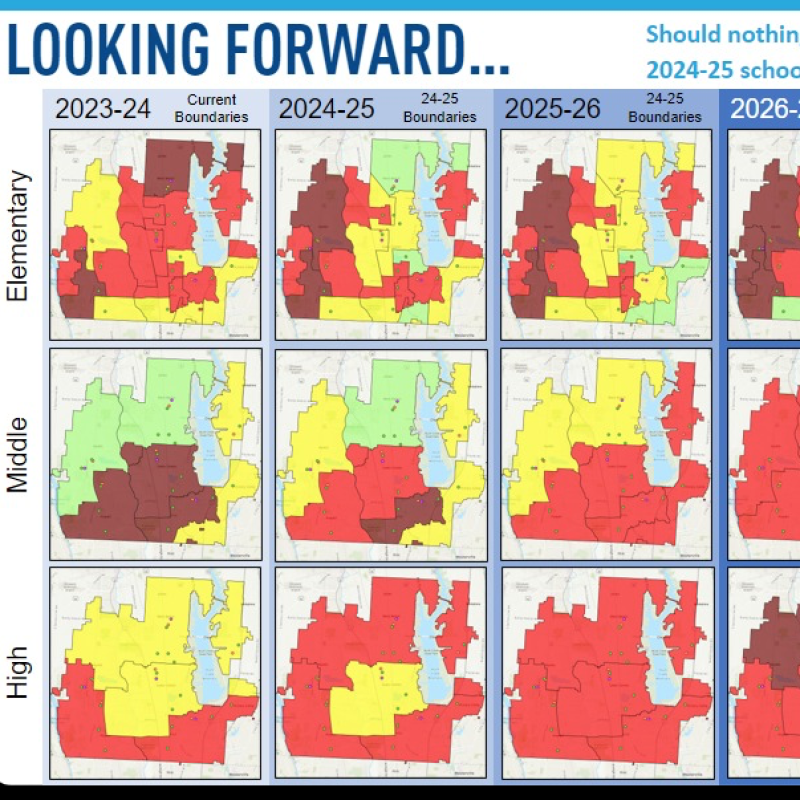

"Even with the addition of Peachblow Crossing Elementary, modular classrooms may need to be added to elementary schools as early as the 2024-2025 school year.

"Without passing the 2024 ballot, modular classrooms may be needed at up to nine elementary schools by the 2026-2027 school year in all quadrants of the district.

"This is not just at the elementary level. Middle school and high school enrollment is growing rapidly as well."

-

A bond issue is a property tax used to provide funds for school facilities. Bond dollars pay for the construction of new buildings, buses and technology. Money collected from a bond issue cannot be used for operations.

-

An operating levy is a property tax used to pay day-to-day operating expenses in a school district. Operating levy dollars pay for expenses such as personnel, utilities, and classroom supplies.

-

Permanent improvement levies are funds that will be used exclusively to maintain and improve buildings, property and equipment.

-

Bonds, operating levies, and permanent improvement levies are taxed in terms of “mills”.

-

A mill is a fraction (1/1000th) of the community’s total property value.

-

In more complicated terms, effective 2013, the state of Ohio no longer subsidizes local levies with a 12.5% rollback for new millage. Therefore, for this ballot issue, one mill represents $35 in annual residential school property taxes for every $100,000 of home valuation, as determined by the County Auditor. For all millage approved in Olentangy prior to 2013, millage will remain at $30.62 in annual residential school property taxes for every $100,000 of home valuation, as determined by the County Auditor.

The 3.00-mill operating levy will collect approximately $20.4 million for district operations, and the 1.25-mill permanent improvement levy will collect approximately $8.5 million for the maintenance and upkeep of facilities. The combined estimated annual collections will be about $28.9 million.

The combined ballot issue will cost homeowners $148.75 annually for each $100,000 of their appraised value, which is determined by the county auditor.

-

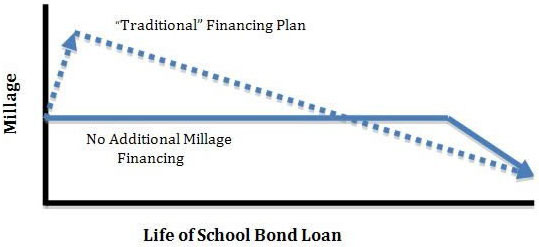

This bond portion of the ballot issue will be listed on the ballot as being for $350 million. The district is required by law to use ballot language as if it will be collected as a traditional bond, so the ballot language will list 2.72 mills. However, due to rapid growth, our district is allowed to provide the bond to taxpayers at no additional millage.

-

This plan addresses growth while keeping our tax rates low. Current residents should see no increase in their tax rate for school bonds, which results in future residents paying more than they would have under a “traditional” debt structure.

-

Structuring the bond debt in this fiscally responsible manner creates a situation in which future residents pay more of their fair share. Those already living in the district should see a much lower millage than they would have under traditional debt funding. Olentangy has used this method of financing schools and other long-term needs several times in the past 24 years.

The operating levy will be used to fund the day-to-day operations of our growing district, including salaries, benefits and other supply and material costs to operate our schools. The operating levy will also provide the funds that allow us to continue to address increased staffing needs to match growth, which will keep class sizes at appropriate levels and avoid the use of modular classrooms. Finally, the operating levy will allow us to expand our security personnel to include our elementary schools.

- Elementary School #18 will be built on district-owned land on Bean Oller Road, west of Sawmill Parkway

- Elementary School #19 will be built on district-owned land adjacent to Berkshire Middle School on 3B's and K Road

- High School #5 will be located on district-owned land on Bunty Station Road, west of Sawmill Parkway

- Middle School #7 and Elementary School #20 sites have not been finalized, but will tentatively be located on district-owned land on Curve Road, in the central part of the district to the north of Berlin High School.

While the district is large, splitting the district in two would not necessarily reduce enrollment growth in the region, and would also no longer allow administrative costs to be spread over the current 23,000+ students and growing. Eliminating the benefit of economies of scale would strain resources, add additional administrative personnel, increasing costs for all involved.

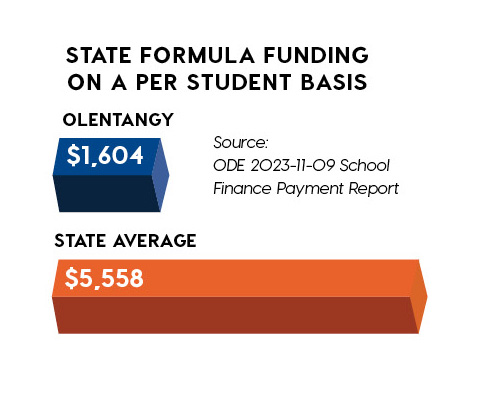

Olentangy received long-awaited funding relief as Ohio lawmakers prioritized fair school funding in the biennium budget last summer. House Bill 33 includes key provisions that affect Olentangy’s state funding to provide tax relief to our community. While this development has reduced the levy ask, it does not eliminate the need for a levy entirely as the District makes plans to accommodate current and projected growth.

In order to have the money to build schools, bonds must be sold. In order to sell the bonds, voters must approve the sale. The bonds will be paid off with future tax revenue, meaning your current tax rate on bonds is not expected to increase.

The Olentangy Local School District is made up of 4 cities (Powell, Westerville, Delaware and Columbus) and 7 townships (Genoa, Berlin, Berkshire, Orange, Liberty, Concord and Delaware). Each of those municipalities controls the zoning in their respective areas. School districts do not have a say in zoning matters.

School districts and townships cannot impose builder or “impact” fees as it is against the law. However, the property to build Peachblow Crossing, Shale Meadows, Oak Creek, Olentangy Meadows, Johnnycake Corners, Tyler Run, Liberty Tree, Glen Oak elementary schools and Hyatts Middle School were all built on land donated by builders.

Residential housing growth does not cover the cost of a new school, and in most cases it doesn’t even cover the cost to educate the additional students. Enrollment growth comes from two sources – new home construction and existing homes. Property taxes from new homes built in our district provide some additional revenue. However, they also add children to educate. Residential growth often costs our district far more than the revenue it generates.

Ryan Jenkins, Olentangy Schools' Treasurer, has shared the following information:

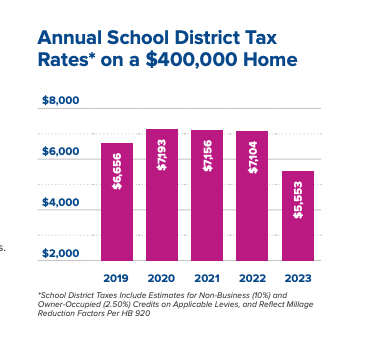

It takes up to eighteen months for a new home to be on the tax duplicate so that taxes are paid on the home. Furthermore, it costs the district $13,735 to educate each student in the ’22-’23 school year. So, if a family has two children in school, it costs the district $27,470. The average value of a single-family home in Olentangy is $400,844 (CY22 value). A $400,000 home provides about $5,553 in property taxes for 2023 to Olentangy Schools. At the current school tax rate for operating millage and at the current cost per pupil, it would take a homeowner of a $400,000 home in Olentangy 32 years to pay for just one student’s education K-12.

Yes, every residential homeowner within the Olentangy boundaries pays the same school tax rate. Other taxes, such as library, EMS, fire and police, vary among the townships and municipalities.

Apartment buildings are commercial property, so they pay a higher school tax rate than residential homes. Whether that commercial tax is passed on to the renter is up to the landlord. In additional, apartments generally yield fewer students than single family homes.

According to the Cooperative Strategies’ Student Potential Analysis Report dated 9/27/23, there are 1,387 students living in apartments and 31 students living in townhomes within the Olentangy School District. Combined, this represents less than 1% of the district’s total student population.

To accommodate our growth, minimize redistricting processes, and receive the best pricing for our building investments, the district currently plans to open elementary schools 18 and 19 in the fall of 2025, high school 5 in the fall of 2027, and elementary 20 and middle #7 in the fall of 2028.

The state requires all public school districts to educate students with disabilities at the preschool level, ages 3 to 5 years old. You can learn more about the district's preschool program here.

Olentangy spends more on instruction and less on administration in actual dollars and as a percentage of total cost per pupil than the average of all school districts in Ohio. In fact, according to the Dept of Education's FY23 District Profile Report, Olentangy Schools spends $1,471 per pupil on administration while the average school district in Ohio spends $2,083 per pupil on administrative costs.

The District continues to operate in a fiscally responsible manner. See the graphic below for recent initiatives that save taxpayers money.

Public school districts generally receive the same amount of voted tax revenue as they did when voters initially approved each levy. That means that voted millage rates for schools decrease when property valuations increase. (There's a small number of mills that the state allows to increase as property values increase. These are called inside mills or non-voted mills.)

Ryan Jenkins, Olentangy Schools Treasurer, provided OFK with this information: The Olentangy residential community has a total millage rate of 84.7 mills for operating levies (this includes 1.5 mills of Permanent Improvement levies). However, residents are actually paying 37.7 mills for operating levies in the 2023 tax year (bills paid in 2024). This is called the effective millage. This reduction is the result of House Bill 920 from the 1970s, which does not allow school districts to get inflationary increases from voted levies. For example, the May 2020 levy for 7.4 mills which started collection in 2021, will collect from residents at 4.96 mills, and the May 1999 levy for 7.2 mills will collect at approximately 2.60 mills.

The chart below shows Olentangy taxpayers' bill over the last five years on a $400,000 home valuation. This chart, along with additional financial information, can be found here.

No money was spent on the superintendent search. The search was managed by the ESC, of which Olentangy School District is a member.

That is not to be interpreted as a bogus search effort. To the contrary, the district interviewed qualified candidates. In addition, community members were involved in the interview process.

According to a recent OLSD post, the average high school enrollment in Ohio is 700 students, while Olentangy's average high school enrollment is 1,823. The average 6-8 middle school enrollment in Ohio is 500 students, while Olentangy's middle schools are almost double that, averaging 925. The average K-5 elementary school enrollment in Ohio is 434 students, while Olentangy's average elementary enrollment is more than 650.

The District’s post continues, “When school buildings have enrollment that exceeds their capacity, there is less opportunity for individualized student attention, connection, and relationship building. Larger buildings can create a less personal experience for students, which has a direct effect on school culture and students' engagement in their education. Higher enrollment at schools means reduced opportunities, both in extracurricular activities and elective classes.”

Tax Increment Financing (TIF) is an economic development tool that can be used by both political subdivisions like a township or a city and a developer to develop a piece of property and get the needed public infrastructure such as roads, sewers, sidewalks and waterlines.

According to the district's 5-year Forecast, "One of the largest sources of other revenue for the District is the revenue from TIFs." The total collections for the for the 2022 (payable in 2023) tax year was $34,582,488.

OLSD Treasurer Ryan Jenkins took time to explain how TIFs impact Olentangy Schools at a recent school board meeting. You can listen to his presentation here.

Even with the addition of Peachblow Crossing Elementary, the Facilities Committee is projecting that trailer classrooms may be needed at Glen Oak Elementary and Scioto Ridge Elementary starting this August.

All 4 high schools are at or over 96% capacity

District leadership projects continuous, multiple redistrictings at all building levels to balance overflow if additional schools aren't built.

If the March 19th ballot issue fails, the Facilities Committee projects that 5 elementaries may need trailers in the 2025-2026 school year, and 9 elementaries may need trailers in the 2026-2027 school year.

“Olentangy is at an enrollment cliff creating an immediate need for more schools to maintain our educational quality.” - Todd R. Meyer, Superintendent

According to District leadership, class sizes will increase if the March 19th ballot issue fails

All fifth graders at Cheshire Elementary are currently in trailer classrooms